Both Jew and non-Jew agree that this year, and the next one, we may be approaching the economic crisis.

Category: Peter Schiff

Mike and Peter

Doctor Doom

With the exception of the blogger Mindweapon, no one in the pro-white movement seems to be aware that we are heading straight toward an economic collapse and a foreign debt crisis of epic proportions. This will happen when the US’s creditors impose a lending ceiling to the traitorous US government.

Now that the US government-created phony crisis is over and that the debt ceiling will be raised for the Nth time, I would like to point out that I have embedded quite a few videos by Peter Schiff, called “Doctor Doom” by the media, explaining the subject (here: must-watch clips for those still clueless that we are living near the end of the long Diktat after 1945.

Of course, you may prefer to see directly Schiff’s latest videos in his own YouTube channel (here). Whatever you chose, this is the most important subject for all those who desperately crave for the long interregnum imposed by the Americans on Europe to end.

Economic illiterates

Greg Johnson’s latest article, “Premature populism,” reminded me my favorite comment by Ward Kendall in this blog:

The moment Billy Pierce started selling “hate core” CDs via the National Alliance’s putrid distributor Resistance is the moment he shoved a figurative gun barrel clean down his clucking, chicken-skinned, babbling throat and yanked the trigger.

Brainz wuz eberwheres, folks!

Kendall is right. And Johnson is right too that—as I interpret his latest article—, since the US is not economically suffering like Greece, Americans still cannot have the benefits of a movement like Golden Dawn.

But like most white nationalists Johnson ignores that America’s bottom will drop out sometime during this decade. See for example the first comment at Johnson’s piece: a whole essay on its own where a commenter, suffering from typical normalcy bias, imagines that business as usual will continue… until 2045!:

If, a hundred years and more after Hitler is dead, it’s still too soon for any assertion of white interests, I think that would be a logical reason for being pessimistic about our prospects.

Here at WDH I have been embedding quite a few Peter Schiff videos (see for example this one) that, with the honorable exception of the commenter John Martínez, have not convinced anyone.

Why people, why? Because Schiff is of Jewish extraction?

Oh boy! I own a copy of the documentary film End of the Road. If some of the regular commenters want to listen voices of economists light-years away from Counter-Currents’ point of view on economics, including gentile voices of course, let me know. I could lend the DVD by mail to those who are willing to listen the pretty solid arguments of those who have been predicting the crash since Alan Greenspan started to print dollars like crazy (and let’s not talk of Obama’s Jew, Ben Bernanke).

Thanks to the fact that, as Mike Maloney says, “fiat currencies always fail” and that “there’s no exception to this,” the days when white populism are no longer premature in America are closer than what the average nationalist imagines.

Washington’s

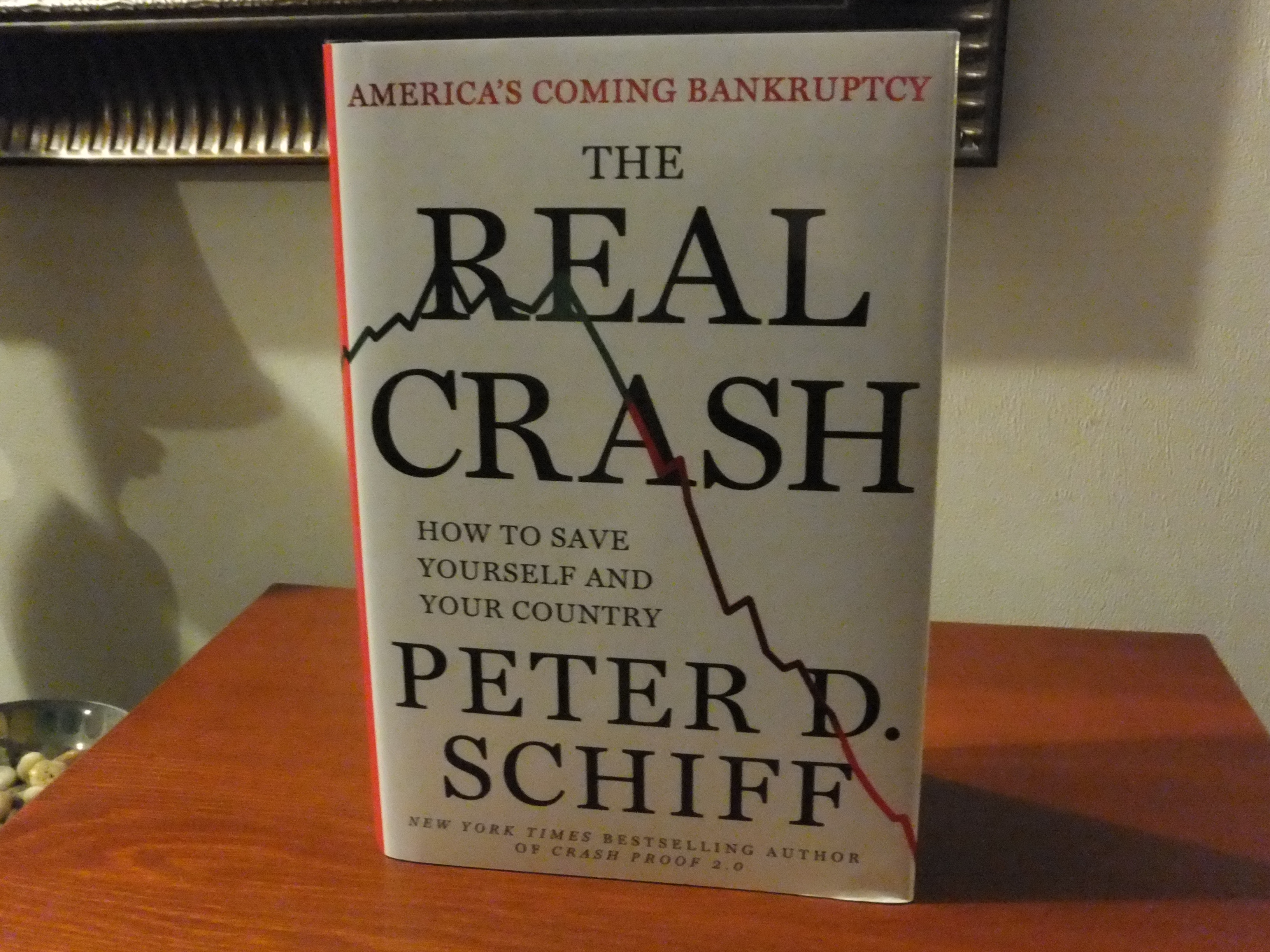

Peter Schiff’s latest book

Below, excerpts of some of Amazon’s reviews of the recently released The Real Crash: America’s Coming Bankruptcy.

I have spent the past four years unlearning all the nonsense we are taught in public schools. The [book’s] message is clear, to the point and given in a manner that anyone should be able to understand. Peter is a great American as well as his dad, Irwin Schiff who has his own library of books that are must-reads.

♣

This book is a super reference and commentary of our current economic reality and likely pending disaster. After reading the hardcover copy, I’ve found this book to be an ideal compendium of today’s economic realities that encouraged me to also purchase the audio edition to share with my teenage kids in the car in hopes that they will get their minds wrapped around the inevitable realities we will all be forced to address in our own lives.

Last but not least, Mr. Oliver Wyman, the gentleman that reads The Real Crash in the audio edition has a wonderful tone with his voice and is a joy to listen to. He demonstrates a perfect balance of enthusiasm for his reading and the subject without being overly dramatic. Perfect clarity in his voice and a listening pleasure.

♣

Peter Schiff predicted the housing bubble and explained how it was created in foresight better than anyone has explained in Hindsight! I had only heard of him this year in February and had no knowledge in economics. I tuned into schiffradio.com everyday since and have learned so much in economics (plus watching all Peter Schiff videos on YouTube). I bought his book, How an Economy Grows and Why it Crashes and learned fundamental economic principles that got me ready to understand this book. The Real Crash is a great book. In it, Peter explains where we were, where we are, and where we are headed and what we can do to save ourselves from this crash. Schiff makes it easy for people who don’t know that much about economics to understand what is going on. I highly recommend this book, and recommend you get your friends and family to buy a copy. Save yourselves. Thanks Peter.

♣

I was first introduced to Peter Schiff in a documentary called Tegenlicht (Backlight) on Dutch television in 2008. In this TV documentary Schiff already foresaw the crash of 2008. From that moment on I started to follow him. From the first moment on this guy made absolute sense. Common sense. From listening to his radio show every day I kinda knew what to expect from his new book. The book was no disappointment. It was again a revelation. Schiff has excellent historical understanding on things and he knows how to connect all the dots. The predictions in this book will come true. I like to compare Schiff with the Greek mythological prophet Cassandra. She was able to see future events but nobody believed her even when the events happened. This is now known as the Cassandra Syndrome. Let’s hope it’s different this time with this book.

♣

Mr. Schiff might have titled this book “The Real Economy”. Using logic, history, and actual cases he takes us through recent bubbles and busts. Mr. Schiff’s track record is pretty good, he accurately predicted the real estate bust two years before 2008.

Central to this book is the idea that it’s impossible to separate the economy and politics. Political agenda creates the economic playing field, and the media adds to our misunderstanding.

♣

If only the boneheads in Washington and the Fed would pay a little attention to what Schiff is saying we might be able to avert economic disaster, but I’m not holding my breath; they didn’t listen before the crash in 2008 and they are not going to listen now. At least individuals can read this book and do what they can to protect themselves from the impending economic disaster created by our overlords in DC.

♣

I get depressed when I read books like this. The Real Crash will likely suffer the same unfortunate fate as the other great books written by Austrian economists and libertarian philosophers. That is, despite offering an insightful and precise look at what is wrong with our current economic system, it will largely be ignored by the uninformed and ignorant masses. The “educated” Keynesians will pass it off as nonsense while simultaneously promoting the systems that are now falling in domino-like fashion around us.

It’s easy to accept statism. One only needs to turn on the TV and vote for Obamney to maintain the status quo. It’s not easy to accept the ideas found within this book. The rationality that governs Schiff’s writing isn’t within the realm of capability for most. It takes genuine thought and deliberation.

♣

Peter Schiff has done it again. I truly believe that there’s nobody better at explaining macroeconomics and sound-money policy to the masses than Schiff. Unfortunately, the folks who really need to be reading this book (today’s political class) either aren’t interested or don’t have the aptitude to fully grasp the suggestions that Schiff outlines in The Real Crash. It’s a shame. Make no mistake: the “Real Crash” that Schiff is predicting will come—unfortunately, when it does many Americans will see their savings and standard of living squandered before it’s all over.

If you read this book and still can’t believe that his predications can be true, I encourage you to think back to how excited you were in 1999 when your dot.com portfolio was going through the roof. Then, think back to 2005 when your home value was skyrocketing. How are both of those investments doing for you these days? (Schiff accurately predicted both of those collapses as well). Don’t make the same mistake a third time. Fool me once, shame on you; fool me twice, shame on me; fool me three times and my retirement savings and standard of living will evaporate.

If you read this book and still can’t believe that his predications can be true, I encourage you to think back to how excited you were in 1999 when your dot.com portfolio was going through the roof. Then, think back to 2005 when your home value was skyrocketing. How are both of those investments doing for you these days? (Schiff accurately predicted both of those collapses as well). Don’t make the same mistake a third time. Fool me once, shame on you; fool me twice, shame on me; fool me three times and my retirement savings and standard of living will evaporate.

You’ll never read accurate information like you’ll find in this book within today’s mainstream media. You have to decide—do you want patently false “good news” or accurate and timely bad news (Schiff) that will protect you and the ones you love? When it comes to protecting my family, my choice is clearly the latter. As Schiff often says, “Medicine tastes bad, but you have to take it in order to get better”.

♣

I consider Schiff one of the greatest threats to those who would destroy our nation, an unusually well-informed and even keeled speaker, and strong writer. (I discount my misconceptions of what this book was supposed to be about but limit my review to 4 stars due to the typos.)

♣

Our Government has been doing since 1971. The debt and GDP have risen in tandem since that time period. Overwhelming in size and not payable and aided by a zero interest rate, this is the perfect storm, black swan, or whatever you want to call it for the decline of the dollar. Only distractions in Europe and other places temporarily worse off is buying time. Time we are wasting by not listening to Mr. Schiff.

♣

Ayn Rand once said, “The hardest thing to explain is the glaringly evident which everyone has decided not to see.” In this book, Mr. Schiff has done a great job of just that, showing what should be obvious to the mainstream economists and politicians, even though they refuse to acknowledge reality: That the problems facing this country won’t be solved with just a superficial change in leadership or slightly altering our current economic path, but are deep, fundamental problems that will result eventually in the “real crash”. Of course, this will make it likely that this book will be ignored by most, until it eventually can’t be ignored any longer.

♣

We’ll get Zimbabwe-style hyperinflation because it’s the path of least resistance for the criminal elite, and because their actions with bailouts, quantitative easing, and money creation show it’s the path they have clearly chosen. Please buy precious metals only after you’ve heavily stocked-up on necessities like long term storage foods, ammo and other items you won’t be able to buy post-crunch.

♣

This book does an excellent job of summarizing the government policies and programs that are leading the U. S. to economic Armageddon.

♣

A big part of what has allowed the American government to borrow as much as it has (and to keep on borrowing now) is the fact that the American dollar is the world’s reserve currency, which means it is always in demand, and hence people and organizations have been willing to act as creditors in order to get it. For Schiff, though, the sheer size of the debt, and the fact that it is running away faster and faster everyday (and has no realistic chance of ever being repaid) will sooner or later turn investors away from considering the American dollar a valuable reserve—at which point it will lose its status as the world’s reserve, and investors will stop investing in it.

At this point, the American government will have but two options. It can either declare bankruptcy, or it can print the money it needs to pay its debt. In either case, an enormous crash will result, for in the first case, an astronomical sum of money that the economy had assumed existed will suddenly be wiped away, and in the latter case hyperinflation will set in, and the American dollar will be whittled down to worthless.

At this point, the American government will have but two options. It can either declare bankruptcy, or it can print the money it needs to pay its debt. In either case, an enormous crash will result, for in the first case, an astronomical sum of money that the economy had assumed existed will suddenly be wiped away, and in the latter case hyperinflation will set in, and the American dollar will be whittled down to worthless.

At this point, the country will be forced to start over.

♣

Personally I believe Mr. Schiff predictions will come true and he’s one of the reasons I’ll be dropping out of college to prepare for this life-changing event of the dollar crisis.

♣

I’ve studied economics in college for 6 years, yet by far I’ve learned more about economics from just reading Peter Schiff’s books. He has cleared up more liberal thinking fallacies than any economist since Hazlitt, Rothbard, Hayek or Bastiat.

♣

I came across this book just as I finished reading Paul Krugman’s latest offering, End This Depression Now. It is clear that Krugman doesn’t understand what money is and wouldn’t dream of considering that the Federal Reserve is the problem. Luckily for us Schiff does, providing us with simple common sense solutions based on sound economics. The solutions are indeed nasty but the alternative is frightening to imagine.

Protect yourself accordingly.

• The US government bubble is bigger than the housing bubble. It is bigger than the stock market bubble and it’s going to burst

• Americans are at the epicenter of massive global imbalances

• The only reason this phony economy works is because Americans can (momentarily) borrow money to sustain it

• All of the US policy is designed to postpone the day of reckoning beyond the next election

• How America embarked in fiat currency

• Why the whole world economy is phony because of using dollars

…and much, much more.

Weimar US

A few entries ago I embedded a video by Peter Schiff but today, which is my birthday, I indulged myself in watching lots of YouTube videos on the coming financial Armageddon:

The US dollar will be like wall paper

Schiff explains magnificently the dollar collapse

Even for those prepared this is the scenario after the collapse

Of the white nationalist intellectuals of today, none has influenced me more than the editing tastes of Greg Johnson, who recently said in a Tom Sunic radio interview that the metapolitical work should have started fifty years ago.

Alas, if Schiff and several other economists are right, it looks like the US will enter the convergence of catastrophes predicted by Guillaume Faye —financial, ethnic, nationalist and a civil wars— sooner than expected, which means that there will be no time for metapolitical structures as planned by Johnson and others.

I have no friends in the Third World country where I am living for the moment. And at my relatively advanced age of 53 I even allowed myself the luxury of rejecting a recent marriage proposal because the lady… is not sufficiently white. Furthermore, since those whom I am biologically related to have betrayed me and my ideals I’ll soon say good-bye to them forever.

But this is a day to celebrate my birthday in the gloomy solitude of my bedroom.

Cheers…!

P.S. A little piece of advice:

Become self sufficient

Get a gun

Grow food

Get survival gear

Get out the cities

Get gold and silver now

Window of opportunity…

Just like the runaway hyperinflation in Weimar Germany, if the dollar crashes the white nationalists in the US will have their chance—sooner than I expected.

[youtube=http://youtu.be/jj8rMwdQf6k]